Vietnam beckons Malaysia’s property bigwigs with urban boom, reforms and rapid growth

10 November 2025

by Business Times

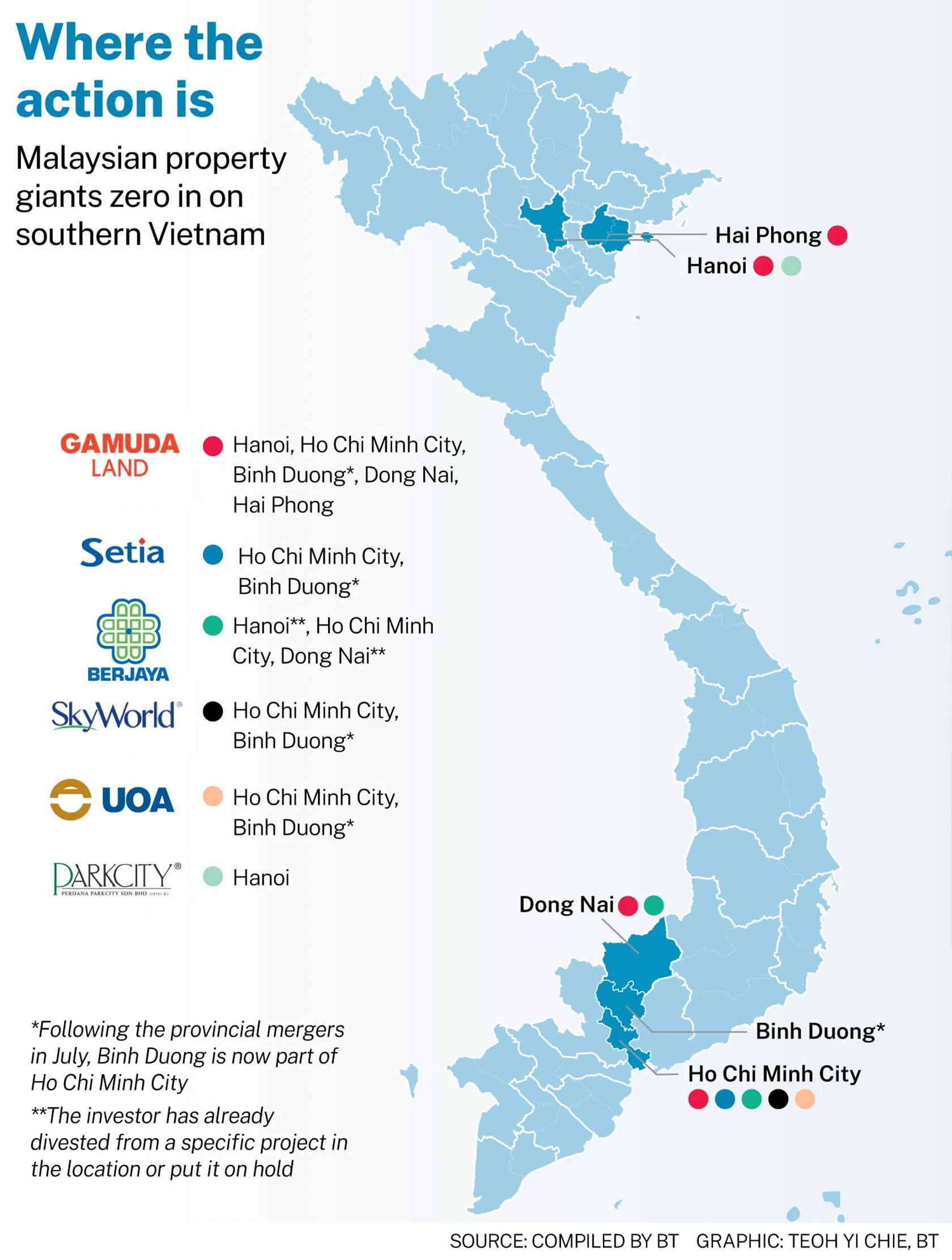

[HO CHI MINH CITY] Malaysia’s property giants are flocking to Vietnam, launching major township projects in and around Hanoi and Ho Chi Minh City, as rapid urbanisation and growth, a rising middle class and law reforms fuel one of South-east Asia’s most dynamic real estate markets.

Vietnam is entering a “new period” of real estate development, remarked Neil MacGregor, managing director of UK-headquartered property agent Savills in Vietnam.

This momentum has drawn Malaysian stalwarts such as Gamuda Land, SP Setia, and SkyWorld Development – developers long known for their expertise in large-scale townships and high-rise communities.

These firms have been growing their presence in Vietnam and acquiring land since the Covid-19 pandemic, and are now benefiting from low interest rates. In recent months, they have begun construction work.

MacGregor added that these players are now also tracking development opportunities amid the roll-out of new ring roads and metro lines, which are opening up new suburbs for township projects and large-scale developments.

He also attributed the rising interest to Vietnam’s revamped property laws, which include legislation governing land, housing and brokerages; these have provided legal clarity, and made planning and approval processes more transparent and efficient.

The new regulations also grant foreign-invested enterprises, with foreign ownership not exceeding 50 per cent, the same treatment as domestic entities in real estate.

These entities are allowed to count land-use rights as capital contributions to encourage the setting up of joint ventures with local firms for new projects.

John Low, South-east Asia managing partner at Roland Berger, said Malaysian and Singaporean developers are being drawn to Vietnam’s maturing market, bringing with them expertise in township planning, mixed-use design and project financing.

They are thus ideal partners for Vietnamese firms and are helping regional players diversify into a high-growth market.

Growth rate sweetener

Hanoi’s Gamuda City, one of Vietnam's largest urban projects, spans 274 hectares and includes residential, commercial and recreational developments, along with Yen So Park, into which Gamuda Land has committed a US$1.12 billion investment. PHOTO: GAMUDA LAND

In the first half of this year, Malaysia’s pledged foreign direct investment in Vietnam skyrocketed by an astounding 270 times to nearly US$1.6 billion from the year before.

This surge was largely driven by a US$1.12 billion investment from Gamuda Land – the property arm of Malaysian construction conglomerate Gamuda – in the Yen So Park project. The project is part of Gamuda City in Hanoi, Gamuda Land’s first venture in Vietnam launched in 2007.

The fresh capital infusion will primarily fund the next phases of the development, which includes community infrastructure, office spaces, and commercial and hospitality facilities.

Gim Teck Yew, deputy chairman of Gamuda Land Vietnam, said the group is investing in Vietnam because of its fast-growing economy, growing middle class and young population.

Vietnam has a population of about 100 million people, with a median age of 33. Over the first nine months of 2025, the country’s gross domestic product expanded by 7.85 per cent year on year. The government is aiming for double-digit GDP growth for the 2026-to-2030 period.

“We see stronger demand for first-time, aspirational housing and community-oriented developments that represent a step-change in quality of life,” said Gim.

He also noted that Vietnam faces a significant shortage of quality housing in the mid-market to upper-mid-market segments. Much of the existing housing is fragmented, with standalone apartment projects lacking integrated planning.

“This gap drives strong demand for holistic townships offering homes alongside schools, parks and commercial amenities,” he added.

Gamuda’s Springville project – a US$393 million, 18.26 hectare development near Vietnam’s new Long Thanh International Airport – was designed to meet global airport-township standards. Within hours of its launch on Jul 6, 97 per cent of the townhouses and shophouses in the development were sold.

The same month, the company unveiled plans for a multibillion-dollar metro line linking Ho Chi Minh City to the upcoming Long Thanh International Airport, which is set to open its first phase in 2026.

Last year, Gamuda Land booked RM5 billion (S$1.6 billion) in property sales, half of which came from overseas. Buyers in Vietnam contributed the lion’s share of its international revenue.

Big Malaysian names zoom in

Other Malaysian builders are also eager to make their mark.

Last year, Malaysian tycoon Vincent Tan of Berjaya Corp was reported to have agreed to purchase a key residential project in Ho Chi Minh City from the imprisoned Truong My Lan.

Berjaya Group has already made inroads into Vietnam, with projects such as Hanoi City Garden, an integrated mixed-use real estate development east of Hanoi, and the Berjaya Vietnam International University Town in Ho Chi Minh City.

In July 2025, Malaysia’s largest developer by sales, SP Setia, broke ground on Setia Garden Residences, its flagship overseas project in Binh Duong, a province to the north of Ho Chi Minh City’s expanding urban area.

The US$81 million development, comprising three towers with 865 units, sits within the larger US$261 million EcoXuan township, which is linked to major metro lines and highways connecting to Long Thanh International Airport.

More recently in September, SkyWorld acquired a 9,400 square metre plot for RM136 million in Binh Duong, where it plans to build a 40-storey residential tower with over 1,200 units, along with commercial and service amenities.

This acquisition is SkyWorld’s second project in Vietnam; it purchased a 5,200 sq m plot in Ho Chi Minh City for another residential development two years ago.

United Overseas Australia (UOA), a global property development and investment company founded in Australia but based mainly in Malaysia, has purchased a prime commercial site in downtown Ho Chi Minh City for US$68 million, boosting its planned investment in the city to US$120 million.

Dickson Kong, UOA’s head of investment, noted that the recent expansion of Ho Chi Minh City and its rapid urbanisation – driven by better education and employment opportunities – are fuelling demand for new commercial, office and lifestyle developments.

He also cited the government’s plans for an International Financial Centre and increased investment in high-tech industries and infrastructure as signs of Vietnam’s shift towards a service-led economy with long-term potential.

UOA, which is listed on major exchanges in Australia, Singapore and Malaysia, entered Vietnam in 2017. Some of its key projects include the UOA Tower and Millennial Tower.

Strong potential returns

Quan Trong Thanh, head of research at Maybank Investment Bank in Vietnam, said Malaysian investors are increasingly drawn to the country’s property sector by the promise of strong returns.

These investors are willing to adopt a long-term strategy, drawing from the experience of their own country, which underwent similar growth periods and market cycles 10 to 20 years ago.

“Confidence has grown as economic reforms have taken hold, making it clear that doing business in Vietnam is now more viable,” he said. “Once issues like US reciprocal tariffs are resolved, the path is clear for further development.”

He also noted that annual returns on property investments in Malaysia tend to be lower, at around 5 to 7 per cent, compared to the double-digit rates of 35 to 45 per cent in Vietnam.

The low entry cost is another big pull, said Roland Berger’s Low, adding that land and construction costs in Vietnam are far lower than in Malaysia or Singapore, even as property prices and rental yields stay high.

Testing affordability

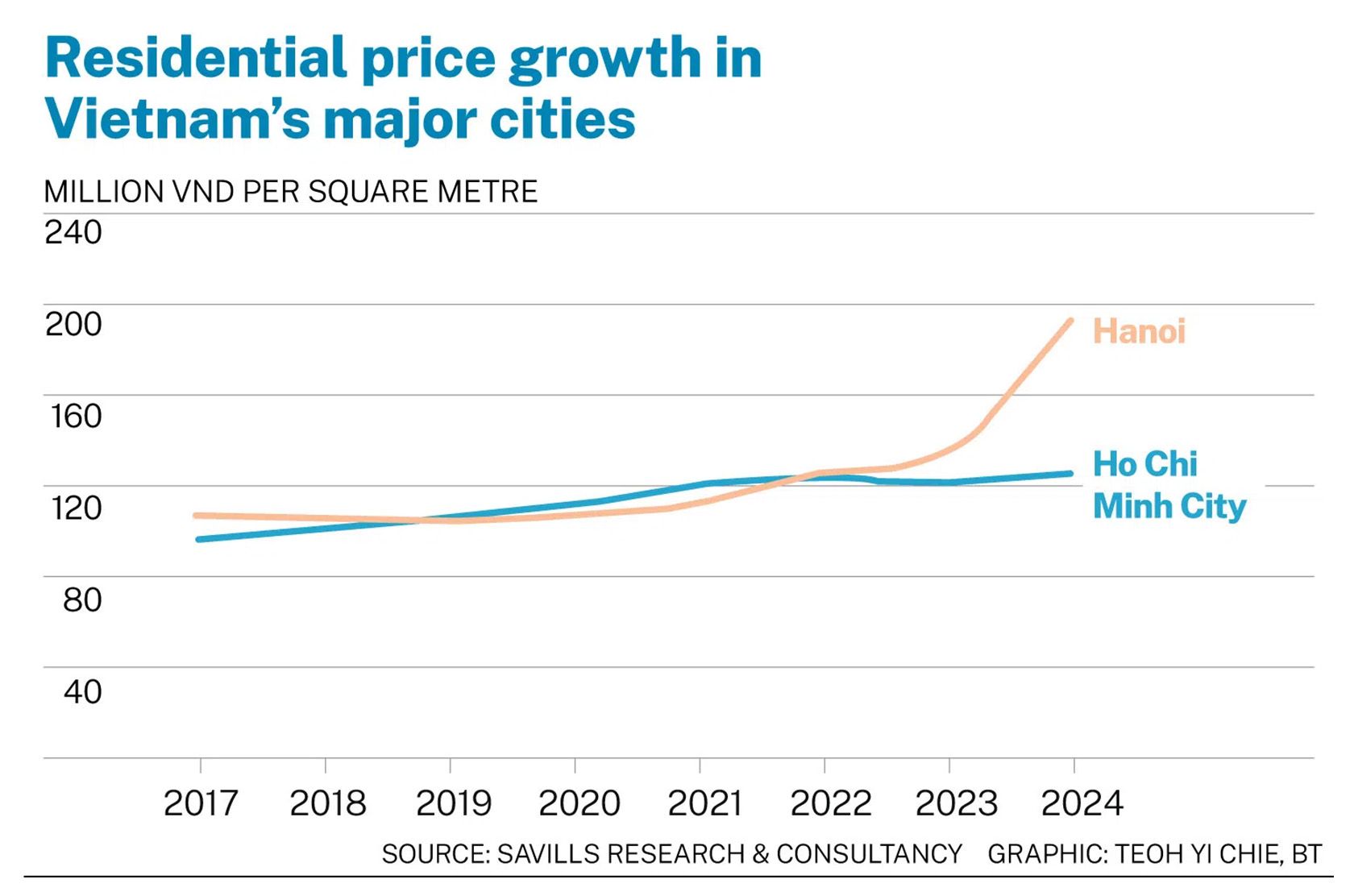

While housing demand remains extremely strong, Savills Vietnam’s MacGregor noted that the ongoing supply shortage in major cities has led to rapid price increases in recent years.

The Ministry of Construction noted that in the first nine months of 2025, average primary condominium prices jumped by a third in Hanoi, and by 36 per cent in Ho Chi Minh City. Demand remained strong, but was tempered by high prices, with transactions rising just 1 per cent from the year before.

Truong Bui, partner and head of South-east Asia transportation practice at Roland Berger, pointed out that foreign developers are often poorly positioned to capture the demand in the affordable and mid-market segments because of high entry costs, limited land access and thinner margins from partnership structures.

Some early movers in Vietnam gained an advantage by securing land affordably in secondary urban areas such as Binh Duong and Dong Nai, but face significant hurdles.

But regulatory complexity, fragmented local execution, financing constraints and limited market transparency can deter investors, he added. Project approvals – covering land clearance, planning and licensing – can typically take three to five years.

Gamuda’s Yen So Park project had been delayed for nearly eight years when a fresh billion-dollar investment was pledged earlier this year. The authorities attributed the setback to land and planning issues, shifting regulations and Covid-19 disruptions.

The US$2.2 billion Berjaya International University Urban Area project languished for 17 years, hobbled by legal and resettlement hurdles. After Vinhomes took over in 2018, the project received a revised licence this year, as the new Land Law addressed key bottlenecks. The project is slated to launch within the next decade.

Singapore’s Keppel last month revived its S$433.6 million Saigon Centre Phase 3 in Ho Chi Minh City, after decades of delays caused by the complex transfer of land from multiple state-owned entities.

“Many foreign developers focus on the premium or upper-mid segments to offset high development costs, often neglecting affordability,” Roland Berger’s Bui added.

MacGregor said the government can address rising prices by increasing land supply for developers and fast-tracking planning approvals.

“By releasing more land, price growth can be moderated, leading to housing prices that better align with actual demand,” he added.

Related Stories

Incorporating biophilic design in a holistic manner

06 September 2022

by The Edge

Building for the Future

02 September 2022

by The Star

Innovative Solutions for Quality Housing

31 January 2023

by The Star